The rotation of the world’s wealth is always confined to a certain range.

The legacy of some ancient families is always entrenched in the heart of the business world.

Walton, Rockefeller, Watson, Morgan, Disney, Rothschild ……

Behind those familiar names are familiar world-class multinational corporations, whose products penetrate the corners of the globe and whose wealth rivals that of nations.

01 The king of luxury from mergers and acquisitions

Counting among the world’s top 20 billionaires, it is surprising that three of them are from the Walton family, although most of these families are not dealing with cutting-edge high-tech products, but rather an extension of food, clothing and shelter, but they have all made it to the top in their fields.

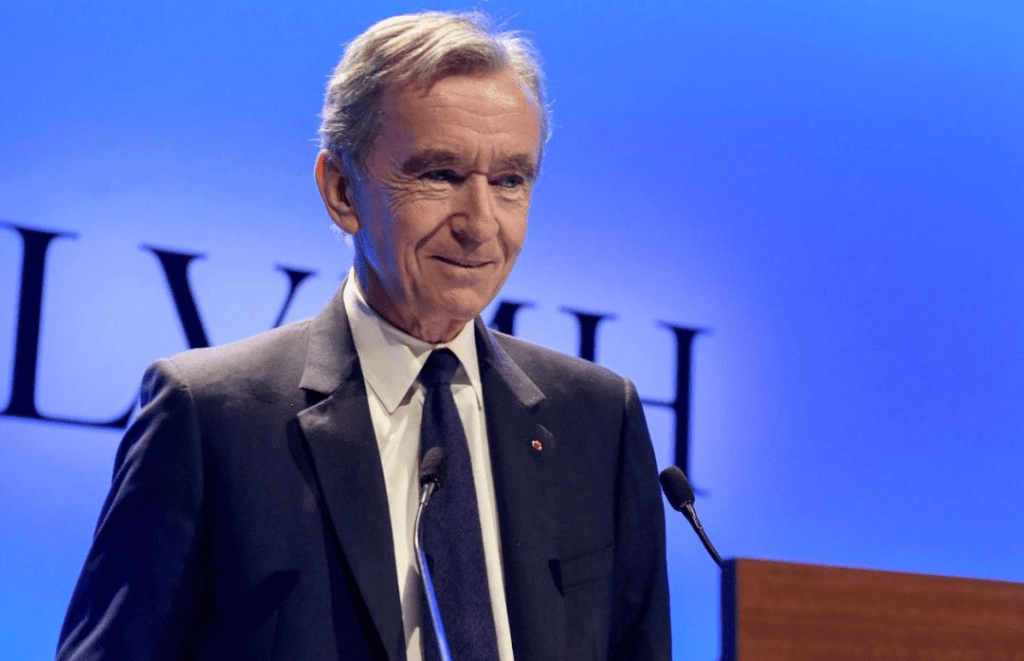

On January 28, Forbes real-time rich list showed that Bernard Arnault, the helmsman of LVMH, once again surpassed Musk, the helmsman of Tesla, to become the world’s richest man.

Bernard Arnault again beyond, on the one hand, because of Tesla’s earnings report is not as expected, led to the decline in its share price; on the other hand is because of LVMH’s fourth-quarter revenue growth of more than expected, affected by this, January 26 LVMH stock price soared nearly 13%, rose to a new record high of 15 years, the market value of 388.8 billion U.S. dollars.

Because of the LVMH stock price surge, Arnaud’s family wealth also surged by $23.6 billion, reaching $207.6 billion, with a slight advantage over Musk’s $204.7 billion.

As it becomes a trend for the world’s headline billionaires to get richer and richer, the battle between the richest will also become more intense. But there is no doubt that this rotation can only happen within a certain range.

01 The king of luxury from mergers and acquisitions

A magazine once commented that Bernard Arnault was underrated as a business magnate.

The magazine argued that unlike Musk, Bezos, and Bill Gates on the list, Bernard Arnault is not a household name, but is a regular on the Parisian catwalks, always making the clothes and the people wearing them the center of attention.

At the helm of a vast luxury goods empire, Bernard Arnault’s family had nothing to do with fashion to begin with.

In fact, the last few generations of the Arnaud family came from a real estate background.

In the 1980s, the French real estate downturn, the Arnaud family successor Bernard Arnaud began to shift to expand the U.S. market.

The experience in the United States, completely changed Bernard Arnault, but also changed his family.

02 Topping the World’s Richest Man

In 1984, Bernard Arnault returned to France after three years in the U.S. and began a series of capital campaigns, perhaps because he had accepted the new ideas of Wall Street, or because he had seen the power of capital from Wall Street.

As the first battle for his fame, Bernard Arnault set his sights on the French textile giant Busac. At the time, Bussac was on the verge of bankruptcy, despite being twice the size of the Arnaud family business. In the end, Bernard Arnault made a desperate attempt to mortgage the family business and paid $15 million out of his own pocket, plus $80 million from investors, to bring Bussac into the fold.

After this battle, Bernard Arnault successfully took Dior under the Bussac flag.

A drunken maneuver that allowed the Arnault family to successfully cut into the luxury sector. After the acquisition was completed, Bernard Arnault also carried out a drastic reform of Busac and began to focus on building the Dior brand. With his maneuvering, it only took two years for Dior to come out of the doldrums and start making a profit.

In 1989, when LVMH’s share price plummeted, Bernard Arnault took the opportunity to acquire a 24% stake in the group for $1.8 billion, making him the group’s largest shareholder.

Eventually, in a powerful internal reshuffle, Bernard Arnault took firm control of LVMH, France’s largest luxury goods group.

Bernard Arnault’s controversial approach to taking advantage of the situation and buying at the bottom of the market led to a rapid and exponential increase in the Arnault family’s wealth.

Since then, Bernard Arnault has gone on a buying spree, from Givenchy to to Hermes (sold in 2014), from Fendi and Kenzo to Bulgari…

Eventually, LVHM became a global luxury goods empire spanning six areas of wine and spirits, fashion and leather goods, perfumes and cosmetics, watches and jewelry, boutique retailing, and other activities in the arts and culture category, with more than 70 brands. It has also made LV one of the most recognizable luxury brands in the hearts of women around the world.

02 Topping the World’s Richest Man

In 2021, the global economy was shuffled around by the epidemic.

Magically, against the backdrop of massive restaurant and factory closures, plummeting offline traffic, and small and medium-sized company layoffs and pay cuts under the epidemic, the luxury industry exploded.

Throughout 2021, LVMH’s net profit soared 156%.

By 2022, LVMH continued to build on the strengths of the previous year and achieved good results, with its revenues, profits, and share price all reaching new all-time highs. With a series of advantages, Bernard Arnault began his assault on the throne of the world’s richest man.

Meanwhile, Bernard Arnault launched his succession plan in July 2022, when he proposed a reorganization of Agache, the holding company that held the majority of his LVMH shares, to divide his shares equally among his five children.

The market is voting for Bernard Arnault’s actions when he is systematically and methodically looking for a successor for the LVMH Group, as the transmission of family wealth, which is crucial for the stability of the company, will avoid triggering market and investor concerns in the future over the company’s heir apparent.

By planning ahead, LVMH can reduce potential leadership transition risks.

With the risks removed, Bernard Arnault overtook Musk as the world’s richest man in April 2023, bolstered by strong LVMH results.

At the time, Musk himself had temporarily lost the richest man’s throne due to his acquisition of Twitter, coupled with a drop in Tesla’s share price. But because of the strong performance of Tesla’s stock price in 2023, Musk was soon back as the world’s richest man.

Of course, Bernard Arnault’s overtaking has already said something, and the likelihood of another overtaking is much higher.

Coupled with the global economic slowdown, consumers “scrimp and save” in the background, the consumption of luxury goods also continued to cool from the second half of 2023.

Therefore, many analysts expressed concern about LVMH’s performance. But to the surprise of the outside world, LVMH’s four-quarter revenue exceeded market expectations, reaching 23.95 billion euros; its annual revenue of 86.15 billion euros, and annual operating profit of 22.8 billion euros, both exceeded market expectations.

Under this influence, LVMH shares rose nearly 13% on January 26, hitting a new high. And Tesla because the performance was less than expected plummeted 13.64%, Bernard Arnault once again surpassed Musk to become the world’s richest man.

Kanji Finance believes that although most of the wealth of the world’s billionaires is linked to the market value of the company’s securities, but as a leading luxury consumer goods company, the cash flow generated by the company is very large. These companies tend to invest little in research and development, but their cash flow is robust, so Bernard Arnault’s wealth is likely undervalued. And LVMH’s better-than-expected results also show that the impact on the affluent middle class in Europe and the United States may be limited, and their spending power is still strong, which also shows that global luxury consumption is still very resilient.