Musk will have to sleep in the factory again, as profits fall for the first time in seven years.

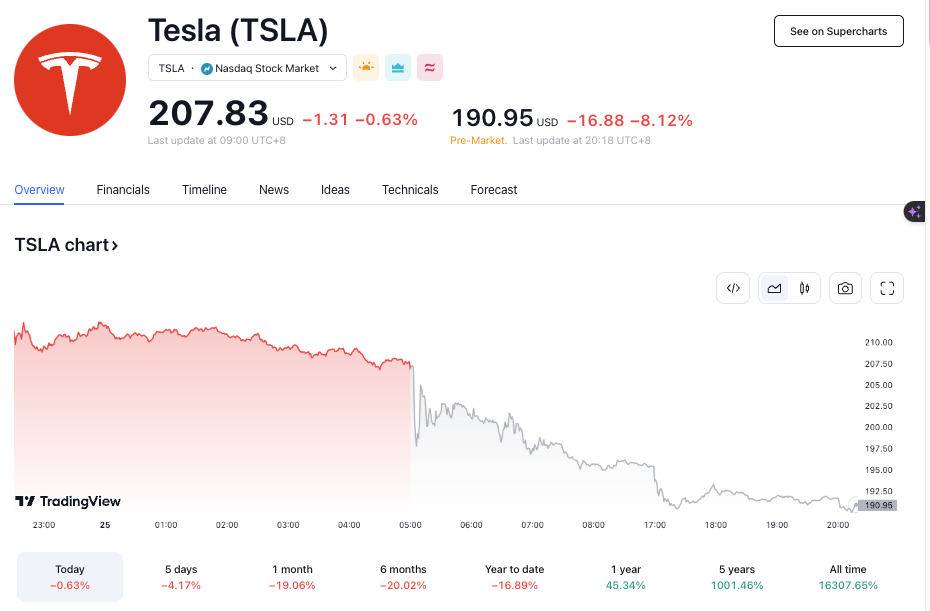

Tesla’s 2023 earnings report showed its first annual profit decline since 2017, with a 40% plunge in Q4 profit, and shares plunged 5% after hours as both revenue and earnings per share missed estimates.

In 2023, Tesla’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) was $16.6 billion, down 13% from $19.2 billion in 2022.

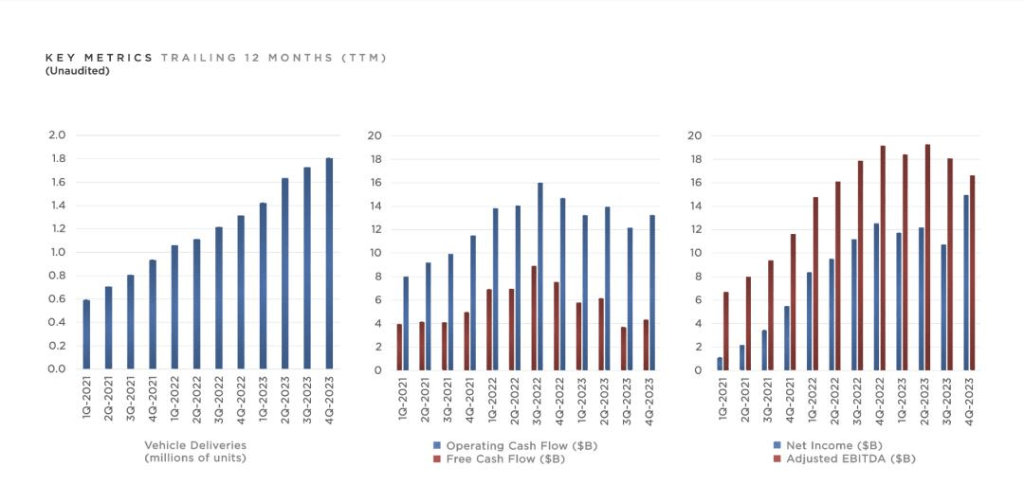

Despite Tesla’s slight weakness in earnings, revenue, and sales hit record highs, totaling $96.773 billion in 2023, a 19% increase year-over-year. A total of 1.808 million new vehicles were delivered in the year, up 38%, with the Model Y being the world’s best-selling model with over 1.2 million units sold worldwide.

However, Tesla did not give a delivery target for 2024, saying only that sales growth will slow this year, after it has been setting its average annual delivery growth rate at 50 percent.

01 Several data lower than expected

Let’s look directly at the specific figures from the earnings report.

Tesla’s total revenue for the year 2023 amounted to $96.773 billion , an increase of 18.79% year-on-year. At this growth rate, it’s no surprise that Tesla’s revenue will exceed $100 billion this year.

Tesla’s core business, the automotive segment, generated $82.419 billion in revenue, accounting for 85 percent of total revenue, up 15 percent year-on-year.

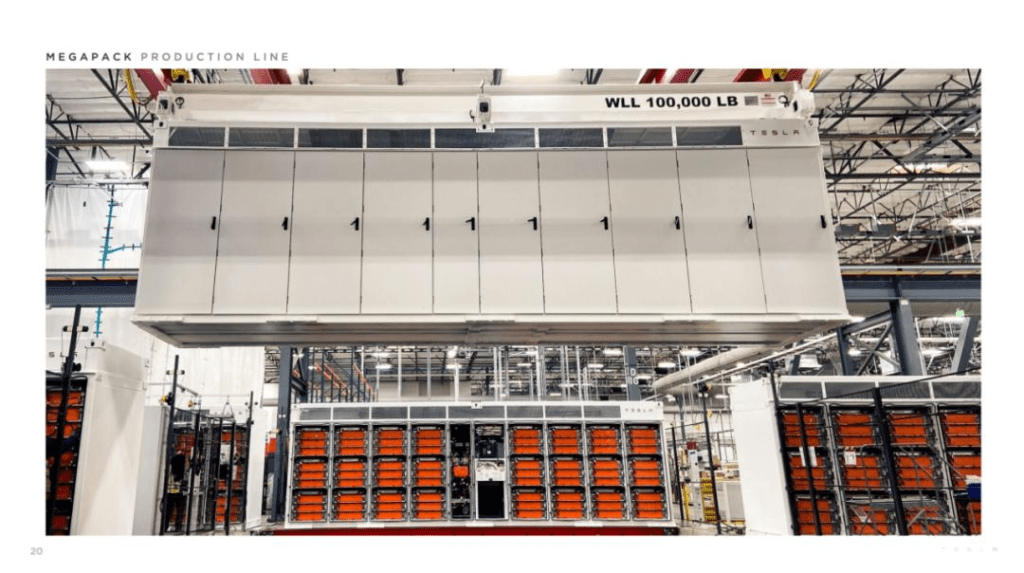

Tesla’s energy division, which sells solar power and energy storage systems, saw a 54% increase in revenue in 2023, contributing $6.04 billion in revenue, and service and other revenue grew 37% year-over-year to $8.32 billion.

Earnings data shows Tesla’s installed energy storage totaling 14.7 gigawatt-hours in 2023, more than twice as much as in 2022. Profits in the Energy Generation & Storage business nearly quadrupled in 2023, while gross profit in the Services & Other business increased from negative $500 million in 2019 to $500 million in 2023.

On a single-quarter basis, Tesla’s total revenue in the fourth quarter of 2023 was $25.167 billion, up 3% year-over-year. Below analysts’ expectations of $25.87 billion, and revenue from its automotive business was $21.563 billion, up only a modest 1% year-over-year, making growth noticeably sluggish.

Tesla kicked off a series of price cuts in the final quarter to boost sales, which also led to a gross margin of just 17.6% in the fourth quarter, the lowest level since 2019, again below analysts’ expectations of 18.1% and down 6.12 percentage points year-over-year.

Tesla’s gross margins have been consistently low for the four quarters of 2023, falling from 19.3% in the first quarter, 18.2% in the second quarter, 17.9% in the third quarter, and all the way down to 17.6% at year-end. The biggest reason for the lower gross margin is still the constant price cuts to promote volume last year, and Tesla also said it was related to an increase in operating expenses driven by other research and development projects.

Still, Tesla’s cash reserves are strong, with an operating cash flow of $13.3 billion in FY2023 and a free cash flow of $4.4 billion in FY2023. Of that, the fourth quarter operating cash flow was $4.4 billion, and the fourth quarter free cash flow was $2.1 billion.

It is worth mentioning that in 2023, Tesla’s R&D expenses reached an all-time high, with the annual R&D expenses amounting to 3.969 billion U.S. dollars, and according to Tesla’s official statement, 3.969 billion U.S. dollars exceeded the sum of the R&D expenses of several new car-making forces.

High R&D brings high output, in 2023, Tesla’s total deliveries were 1.8 million vehicles, up 38% year-on-year, of which the fourth quarter set a record of 484,500 deliveries, and the cost of a single vehicle continued to fall in the fourth quarter, and the earnings report shows that the average cost of sales per vehicle has now fallen to about 36,000 U.S. dollars .

The Model Y has also become the world’s best-selling model regardless of category, power form, or any form of qualifier, with a cumulative total of more than 1.2 million vehicles delivered for the year.

But for 2024 sales expectations, Tesla said in its earnings report that the growth rate “may be significantly lower than in 2023”, giving the reason that it is busy launching the next generation of models.

In addition, Tesla also did not announce specific delivery targets for 2024, some analysts predicted that Tesla’s sales this year may reach 2.2 million units, an increase of about 20% year-on-year.

Tesla is down more than 8% before the opening bell after the earnings report.

02 Growth is in next-gen models

Following the less-than-expected earnings report, Musk also revealed a timeline for the release of a next-generation car, saying that Tesla is “pretty far along” in developing a new low-cost vehicle.

While no details were provided about the car or its timeline, and it was also stated that Tesla would not be discussing product releases on the earnings call, quite a bit of information was revealed about the next-generation model.

Musk said that Tesla is now aiming to launch the next generation of electric vehicles, including a lower-priced model, by the end of 2025. The price would be set at $25,000 to further develop the market.

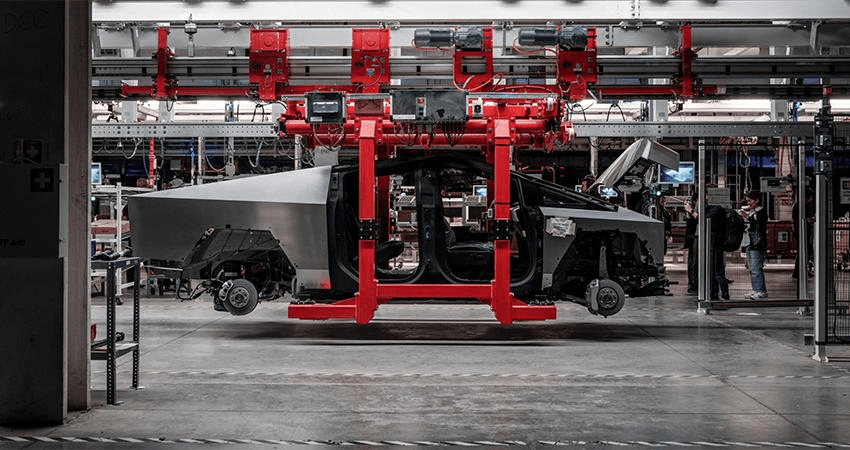

The car will use Tesla’s original Unboxed Assembly Process, an assembly system that, according to Musk, will be faster, more efficient, and reduce costs by 50 percent.

“I’m very excited about this car and its revolutionary manufacturing system, which will be more advanced than any other system of its kind.”

The process, which was previously mentioned at Tesla’s 2023 investor day, is a new automotive manufacturing system – an “out-of-the-box process” – that is claimed to usher in the third reform of automotive manufacturing.

Additionally, boosting production may be difficult, with production to take place in Austin and in a yet-to-be-built factory in Mexico and a third factory outside of North America, for which Musk said “we’re pretty much going to sleep in the factory.”

It’s worth noting that Musk said that this is not a product preview, meaning that there are still reservations about the “late 2025” timeline, and that production could be planned for mid-2025.

Musk commented, “This is going to be a challenging process to bring up production.” Once in production, the model will be far ahead of any other manufacturing technology in the world, and it represents a step up.”

Interestingly, just a day before Tesla’s earnings meeting, Reuters revealed that Tesla’s next-generation car is codenamed “Redwood”. The model, which is expected to begin production in mid-2025, is described as a “compact crossover”.

According to the report, Tesla sent out a “request for quotation” or invitation to tender for the Redwood model to suppliers last year, and expects to produce 10,000 units per week, with production expected to begin in June 2025, according to the report.

Although Tesla’s China staff responded that they had never heard of such news, it’s easy to see that the lower-cost model Musk was talking about is probably the compact crossover code-named “Redwood”.

This model is also regarded as the key to Tesla’s next growth, and according to Musk’s current public statements, the new car will be more focused on “affordability”, that is, more people can afford to buy it.

Tesla has also made a precautionary note in advance, because it is committed to the launch of the “next generation of cars” in research and development, car sales growth in 2024 “may be significantly lower” than last year’s growth rate. And in 2024, the deployment of energy storage business and revenue growth should exceed the car business.

Tesla also explained that it is “currently in the midst of two major growth waves,” the first of which began with the global expansion of the Model 3/Y, and the next will be initiated by the global expansion of the next-generation vehicle platform.

The implication is that Tesla in 2024 is going to be in the doldrums. But Tesla has a long history of averaging 50% annual growth in annual deliveries, and

That’s why analyst Seth Goldstein from Morningstar Research warns, “Tesla is signaling that 50% or even 30-40% year-over-year growth won’t happen in 2024.”

03 FSD to be licensed externally

During the earnings call, Musk also talked about AI, FSD, Cybertruck, and Optimus robots, among a host of other topics.

Previously Musk has said that he remains concerned about Tesla’s technological future in artificial intelligence (AI) and robotics if he can’t secure 25% of the voting rights.

So, at the earnings meeting, he made it clear that he was seeking extra control over Tesla so that he could have more influence over the company’s handling of AI and robotics, and he emphasized that he wasn’t trying to control the entire company, but rather that his current influence over the company was too small, leading to the possibility that he could be “voted down by some random shareholder advisory firm”. vote it down”.

That said, there’s a good chance that Musk will have to buy back some of his stake in the company shortly to maintain his decisive position at Tesla.

As for why he did this, Musk said his desire to tighten controls was based on concerns about the dangers of AI becoming too powerful, and the possibility that activist investors could unduly influence decisions about potentially dangerous technologies.

Talking about FSD Autopilot, Musk said Tesla is the most efficient company in the world in terms of AI application. He said the new auto manufacturing system will be used in the next generation of models built at the Austin Superfactory, and then rolled out to the New Mexico plant as well as other Superfactories.

Shortly before releasing the earnings report, Tesla pushed the latest FSD Beta V12.1.2 to North American owners, and while this version of FSD still doesn’t enable Tesla to drive fully automated, it can handle the absolute majority of scenarios, judging from the demo video that was released.

Musk also mentioned the possibility of FSD being licensed to the public, saying that some car companies may still not believe that FSD will become a reality, but they are having “some tentative conversations”.

Musk also admitted that there are no obvious opportunities to work with Chinese OEMs, although Tesla is willing to help with FSD licensing. This may mean that the FSD push into China will have to wait a bit longer.

Regarding the Cybertruck, an electric pickup truck that will begin deliveries in Q4, Tesla said it expects the Cybertruck’s production ramp-up process to be “longer than other models” given the complexity of its manufacturing.

It is reported that Cybertruck’s current production capacity can reach more than 125,000 vehicles per year, and Musk had said last October that Cybertruck may not be able to generate significant cash flow for a year to a year and a half.

In addition, Musk also mentioned China’s car companies and spoke highly of them, saying they are the most competitive in the world, depending on what kind of tariff policy is used and whether there are trade barriers. If there were no trade barriers, Chinese car companies could take out most of the other car companies in the world.

It also thanked a wave of suppliers from the country in passing, calling them very good partners, including Ningde Times and BYD.

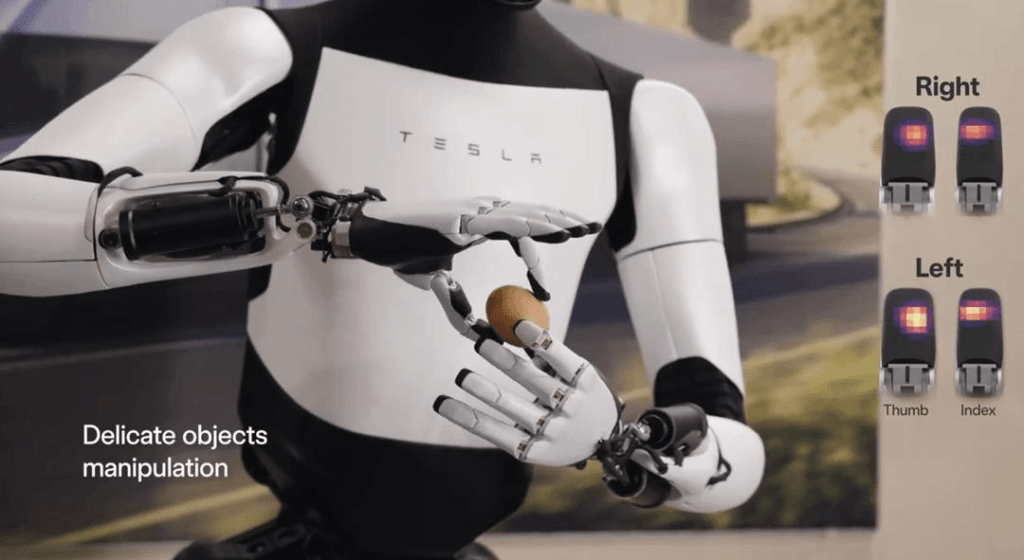

Finally, when asked about the production timeline for Tesla’s humanoid robot Optimus, Tesla didn’t reveal anything at all, but Musk said that Optimus could end up being the company’s biggest business, describing it as “a product that has the potential to be worth far more than all of Tesla’s other products combined! “.

After all, in Musk’s eyes, Tesla wants to be the most valuable company in the world.