The much-anticipated NVIDIA has once again delivered on market expectations.

February 21 after the U.S. stock market, Nvidia announced the company as of January 28, 2024, 2024 fiscal year fourth quarter, and full-year financial results (January 30, 2023, to January 29, 2024, for Nvidia 2024 fiscal year).

The earnings report showed that NVIDIA’s fiscal fourth quarter revenue was $22.1 billion, a 265% year-over-year jump, while net income was $12.3 billion, a 769% year-over-year jump, and diluted EPS was $4.93, a 765% year-over-year increase.

Before the release of this quarter’s earnings, NVIDIA withstood the market’s extremely high expectations, but fortunately, its fiscal fourth-quarter revenue and profit soared year-on-year, far exceeding analysts’ forecasts, stabilizing the stock price after the earnings report. After the earnings announcement, NVIDIA shares jumped 10% after hours.

As of the fourth fiscal quarter, NVIDIA has posted three consecutive quarters of record revenue and profit.

01 How NVIDIA goes, how the market goes

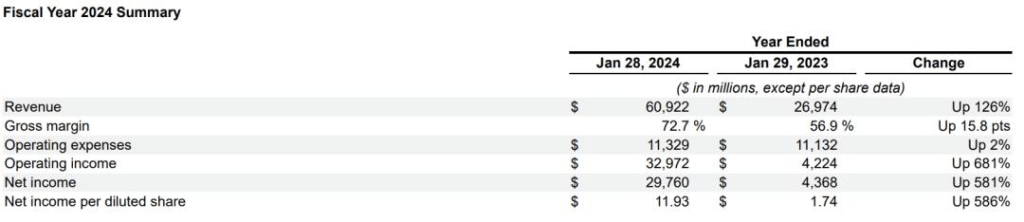

Throughout the fiscal year 2024, the financial report shows that NVIDIA net profit recorded $29.76 billion, compared with $4.368 billion in fiscal year 2023, a surge of 581%, diluted earnings per share of $11.93, compared with $1.74 in fiscal year 2023, an increase of 586%.

On the revenue side, NVIDIA reported revenue of $60.922 billion for fiscal year 2024, up 126% compared to $26.974 billion in the previous fiscal year. Gross margin was 72.7%, up 15.8% compared to 56.9% in fiscal 2023.

By business, the data center is NVIDIA’s largest proportion of revenue segment, In the fourth fiscal quarter, the segment revenue reached a record $$ 18.4 billion, an increase of 27% from the previous year, an increase of 409% year-on-year, and for the full year, the segment revenue increased by 217% to a record$$ 47.5 billion.

For the first quarter of fiscal year 2025, NVIDIA expects revenue of $24 billion, an up-and-down fluctuation range of no more than 2%, much higher than the market expectation of $21.9 billion.

In the past year, Silicon Valley set off a generative artificial intelligence revolution sweeping the world, one of the core foundations behind the arithmetic, that is, graphics cards.

Therefore, GPU-leading NVIDIA has not only become a global technology company’s “lifeblood”, but also by the global capital market starting. If NVIDIA’s performance growth is not as expected, the artificial intelligence boom also means that it is just a gimmick.

Data show that Amazon, Meta, Microsoft, and Google are NVIDIA’s largest customers, accounting for almost 40% of its revenue. On the secondary market, NVIDIA shares doubled about 2.4 times in 2023, and in mid-February this year, the market value once exceeded $1.8 trillion.

Earnings call, NVIDIA CEO Jen-Hsun Huang believes that the industry hardware upgrade is still in the early stages behind strong AI application scenarios, including Sora. He predicted that the industry as a whole would need about $2 trillion of NVIDIA chips to meet future arithmetic demand.

“Fundamentally, the conditions are very good for continued growth in 2025 and beyond.” Jen-Hsun Huang said demand for GPUs will remain high as generative AI and the industry as a whole remain in the process of shifting from CPU dominance to GPU dominance made by NVIDIA.

Commenting on NVIDIA’s earnings, Kim Forrest, chief investment officer at Bokeh Capital Partners LLC, said, “NVIDIA has been a market mover over the last 11 months, and as NVIDIA goes, so goes the market. It really confirms the narrative that artificial intelligence will remain strong for the foreseeable future. That narrative bolstered the market last year, so why wouldn’t it this year?”

After a wild year, it’s clear that the market’s expectations for NVIDIA will only continue to be elevated, with the future outlook for the AI market receiving more attention from investors than short-term earnings numbers, such as future demand for the H100 GPU chip, more details on the next-generation GPU chip, the B100, and a product roadmap planned for next year.

02 Can continue to double?

On the eve of NVIDIA’s earnings report, a rapidly heating options trading market is a side effect of investors’ “NVIDIA faith”.

Cboe Global Markets data show that a few hours before the release of the earnings report, widely traded call options betting that the stock price will jump to 700-800 U.S. dollars range. Among the call options were bets that NVIDIA shares would jump to $1,300, about double the share price at the time.

In fiscal 2024, NVIDIA’s revenue doubled compared to the previous year, and the market is already expecting NVIDIA to double again in fiscal 2025.

S&P Global Market Intelligence compiled data show that analysts generally believe that NVIDIA’s revenue in fiscal 2025 will be about $90 billion, a figure that implies a revenue growth rate of 52%. Although it is already a high rate of growth, compared to last year’s growth rate, the 52% growth rate may be difficult to maintain NVIDIA’s high valuation.

“Wood sister” Cathie Wood previously said that Nvidia is a well-deserved leader in the field of AI, but the market’s expectations are too high, Nvidia may not be able to meet, and with the increased competition and inventory adjustments to bring challenges, she recently sold about $4.5 million worth of Nvidia stock.

So right now, investors are focused on NVIDIA’s new products and high-level earnings forecasts.

NVIDIA CFO Colette Kress said on the earnings call that market demand for the company’s next-generation products is far outpacing supply levels, particularly for the company’s next-generation chip, the B100, which it expects to ship later this year. “Building and deploying AI solutions has touched nearly every industry”, he said. Data center infrastructure is expected to double in size within five years.

The next-generation AI chip, B100, along with the product roadmap, is expected to be formally unveiled at the Graphics Technology Conference (GTC) 2024 on March 18th.

The B100 is said to be three times faster than the H100 in terms of inference. Analysts at Bank of America believe that NVIDIA’s B100 will be priced at least 10-30% higher than the H100, with demand likely to continue until at least mid-to-late 2025. In addition, the B100 will feature a more advanced HBM high-bandwidth memory specification, which is expected to continue to break through in terms of stack capacity and bandwidth beyond the existing 4.8TB/s.

However, increased competition is hard to avoid. Rival AMD recently began selling a line of gas pedals called MI300, and expects $3.5 billion in revenue from the product this year, up from a previous forecast of $2 billion.

Intel, for its part, convened a series of partners and potential customers in Silicon Valley to discuss the company’s plans for chip manufacturing services, with attendees including Sam Altman, chief executive of OpenAI, which relies heavily on Nvidia chips.