On February 2, Apple released its Q1 fiscal year 2024 earnings report. Due to Apple’s special way of calculating the fiscal year, this report actually reflects the results of Q4 2023. Overall, Apple’s report card is a good performance, revenue, and profit growth, farewell to the decline in the first three quarters of 2023.

However, there are still some hidden concerns buried under the more detailed data in this earnings report. Apple’s Greater China revenue fell sharply, and while the iPhone’s share of revenue contribution climbed, revenue from business segments like the iPad fell sharply year-over-year. For the next year, Apple may have to make adjustments to building its product and market strategies.

iPhone is a lifesaver, iPad poses to collect bad results

According to this earnings data, Apple’s Q4 revenue was $119.6 billion, up 2% year-on-year; profit of $40.3 billion, up 12% year-on-year. Among them, the iPhone contributed $69.7 billion, accounting for more than 58%. For a tech giant like Apple that focuses on all-around development, it’s not a good thing that the cell phone business accounts for too much.

Over the past decade or so, Apple has been working on diversifying its business and reducing the revenue share of the iPhone. But it’s clear that the Q4 numbers show that Apple’s reliance on the iPhone has increased again this quarter. As a comparison, in Q4 2022, the iPhone’s contribution to revenue was around 56%.

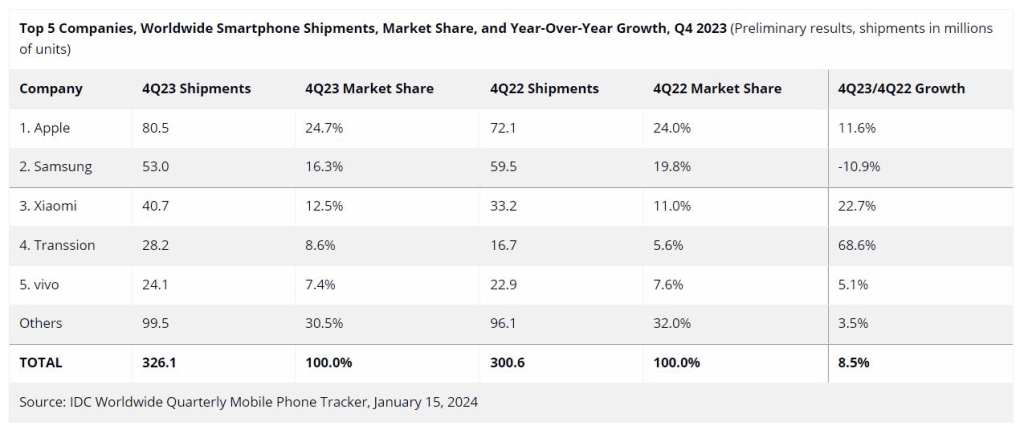

It needs to be acknowledged that the iPhone 15 series is still a big hit in the market despite the many negative comments on the internet.IDC data shows that in Q4 2023, iPhone shipments reached 80.5 million units, an increase of 11.6% year-on-year, and Apple was the world’s top-selling cell phone brand. The hot sales of the iPhone 15 series played a crucial role.

In contrast, the rest of Apple’s business didn’t fare so well, with iPad revenue plummeting 25%. This is actually not difficult to understand, because Apple has not updated any of its iPad products for the entire year of 2023, and it’s not easy to have $7 billion in revenue under such bad behavior.

Frankly speaking, the iPad still has a strong advantage in the high-end segment and has a degree of irreplaceability in both hardware and system ecology. It’s just that new products without normal iterative updates can have a significant negative effect on the market.

What’s more, Android manufacturers have made a lot of moves in the tablet market over the past year, with flagship, mid-range, and entry tablets springing up, and brands have been working on productivity, office, and other scenarios. For many people shopping for a tablet, the iPad is no longer the only option.

Rolling to the extreme, the Chinese market, so that Apple suffered a setback

There’s another obvious minus in this just-out earnings data from Apple – a relatively large decline in China revenue. Specifically, in Q4 2023, Apple’s Greater China revenue was $20.8 billion, down 13% year-over-year. Compared to the overall revenue growth, Apple’s decline in the Chinese market looks a bit harsh.

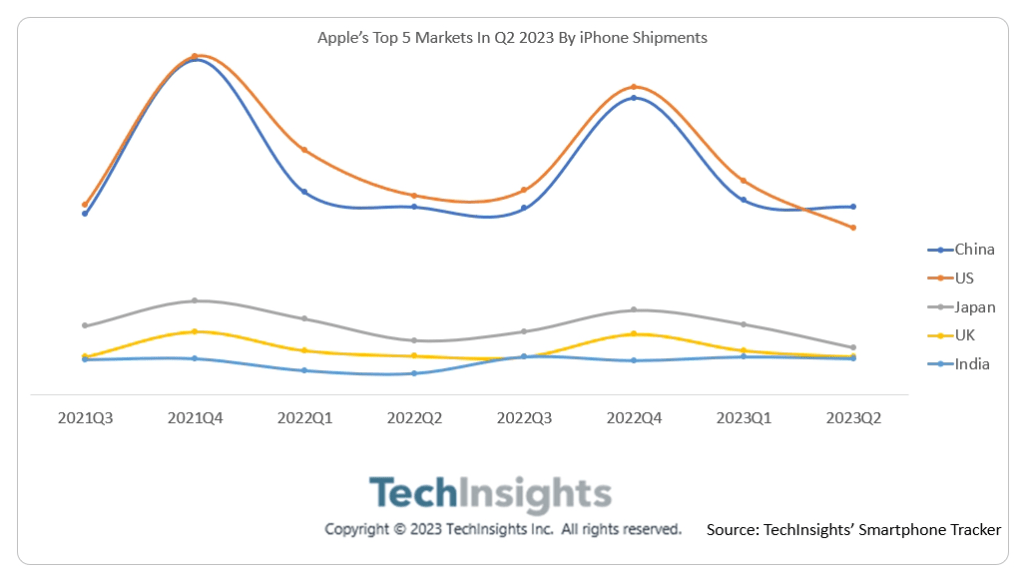

The importance of the Chinese market to Apple is self-evident, Q4, Greater China revenue accounted for more than 17%. In addition, in 2023 Q2, TechInsights published data showing that China became the largest single market for the iPhone in the world, shipments for the first time exceeded the U.S. IDC data show that in Q4, Apple’s cell phone shipments in the Chinese market are about 14.72 million units, compared to the global market share of about 18.30%.

For the loss in the Chinese market, Cook in the earnings call to the general reason attributed to the “overall economic problems”, also emphasized that “we have four of the top six smartphone sales in Chinese cities”. However, Cook’s explanation is not convincing. After all, according to the IDC and other organizations’ statistics, in Q4 China’s smartphone industry rebounded, the overall ushering in growth, but the iPhone shipments fell 2.1% year-on-year.

In addition, at the beginning of 2024, Apple held a rare price reduction promotion for the Chinese market, up to 800 yuan straight down. Although Apple has previously participated in the double eleven, 618 activities, but only through the Tmall platform. This “New Year’s offer” is Apple’s official website and offline Apple Store, which undoubtedly reflects Apple’s concern about lower demand.

On third-party platforms, we can feel the price reduction of Apple products such as the iPhone 15 series. Three months after the launch, the arrival price of some iPhone 15 has exploded by more than 1,000 yuan. So, despite Apple’s Q4 sales results in China, many of them have been discounted on the selling price.

It’s worth noting that Huawei re-entered the list of Top 5 shippers in Q4 2023, with sales up by 36.2%. With models such as the Mate60 series, Huawei has returned as king in China’s high-end market, and it’s a given that it will seize Apple’s market share.

Undoubtedly, China is the most rolled-up single market in the global cell phone industry, and the major Android headline brands are staggeringly implosive in terms of technology, products, and prices. Over the past year, domestic manufacturers have made a lot of technological innovations in cell phone products, and have created several high-end flagship products, which can fight hard with Apple in various aspects such as performance, image, screen, building, and materials.

From the results, Apple has kept the lead in the Chinese market, but the results failed to meet expectations.

Apple needs to open up more growth tracks

Over the past few years, Apple’s strategy of “de-iPhoneization” has yielded some results. Now, the business outside the iPhone has been able to contribute more than 40% of Apple’s revenue. Q4, Apple’s service business is still the strongest growth, up 11.3% year-on-year to $23.1 billion, which is more than the iPad and Mac combined. However, the growth potential of Apple’s current business can almost always be seen at a glance to the end, Cook needs to open up new growth tracks.

The most innovative product Apple will release in 2023 will undoubtedly be the Vision Pro, a headset that has already been available for pre-sale in the U.S. market, with an official launch date of Feb. 4, local time. In the conference call after the release of the earnings report, Cook once again mentioned the Vision Pro to emphasize Apple’s continued efforts in innovation.

At present, the first batch of foreign media review content about Vision Pro is out. For Vision Pro, the disadvantages that people complain about mainly include heavy, poor battery life, many bugs, and insufficient ecological richness. As for the advantages, Vision Pro has a strong configuration and can bring a very high sense of immersion. But overall, Vision Pro is still a unique presence among civilian XR products.

According to MacRumors, Apple salespeople have revealed that the Vision Pro has already sold more than 200,000 units in about 10 days after it opened for pre-orders. According to previous predictions from Ming-Chi Kuo, the Vision Pro could sell around 500,000 units for the entire year of 2024. If this prediction is accurate, Apple will be able to earn more than $1.7 billion in revenue from the Vision Pro this year. Such a sum of revenue seems a bit insignificant compared to Apple’s overall revenue. But XR is an industry with a broader future, and headset products like Vision Pro hold Apple’s hopes of opening up new markets and finding new growth points.

So, outside of Vision Pro, what other new tracks can Apple look for? Building a car was once seen as the business that could bring the most incremental growth to Apple, but it’s clear that Apple’s step to building a car is too big, and the vision of redefining the automobile is somewhat unrealistic. With the departure of the key technical backbone, Apple’s car-making business has been at a standstill.

Before that, AirPods, and Apple Watch can be regarded as Apple’s successful innovative products, they not only bring new growth to Apple, but also open up a whole new market. Only, whether the future can replicate such a successful case, Apple must maintain the advantage in the accumulation of innovative technology and market demand insights.

Write in the end

On a business level, Apple is clearly one of the most successful tech companies throughout 2023. Over the past four quarters, Apple’s overall revenue has basically only declined slightly, and profits have been growing for multiple quarters. And, for the first time in the cell phone industry, Apple has also taken the top global sales spot. Obviously, Apple’s strategy of maximizing profits has worked, and the goal of guiding users to buy more expensive products has been achieved.

Of course, for most average users, Apple is still a company that consistently makes great products. In the next year, the iPad and AirPods product lines are expected to be updated, and the Vision Pro may be sold in more markets.

Just behind the beautiful earnings report Apple delivered, there are still some problems. iPhone suffered a setback in the highly competitive Chinese market, and overall revenue fell sharply. Research organization PerfectRec recently released a report showing that the iPhone 15 Pro, the main model in the iPhone 15 series, continues to suffer from low user satisfaction due to issues such as battery life. The EU’s upcoming implementation of the Digital Marketplace Program has also created unprecedented challenges to Apple’s long-held iOS closed ecosystem.

Under the pressure of new growth, how to open up more new tracks may be Apple’s next problem to focus on.